Converging Crises Reshaping Global Order

Key Drivers of Discontinuity - Our Internal Forecasts

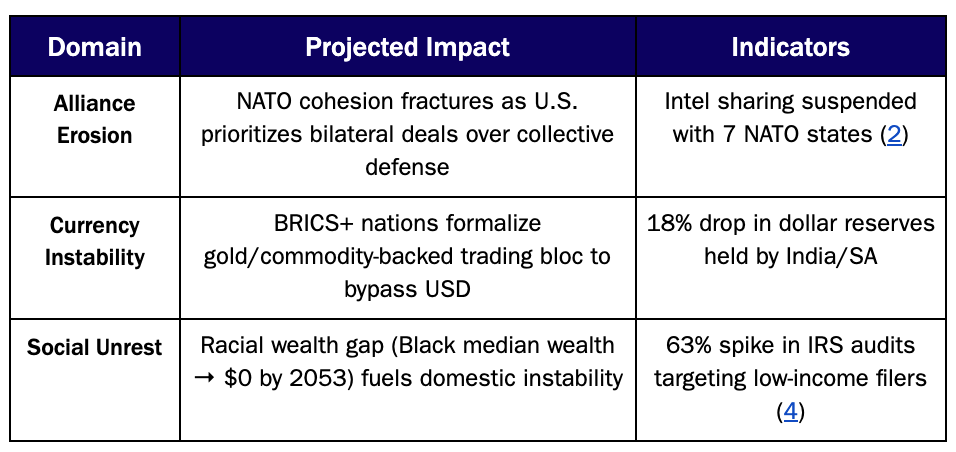

Fragmentation of the Global Internet: Transition from a U.S.-led "Pax Digitalis" to competing national security internets (1).

U.S. Strategic Realignment: Intelligence-sharing normalization with Russia and transactional NATO engagement (2).

Targeted Trade Warfare: Trump’s reciprocal tariffs (145% on China) accelerating de-dollarization and supply chain Balkanization (3, 5, 6).

Weaponized Wealth Inequality: Top 1% controlling 70% of U.S. wealth, exacerbating societal fractures, exploitable by adversarial influence campaigns (4, 7).

// Image shows Monaco, one of many ZERO TAX jurisdictions globally.

Near-Term Consequences (0–3 Years)

Critical Vulnerability: U.S. tech firms face exclusion from EU/Asian markets under “data localization” mandates, ceding cloud/AI infrastructure to Huawei and Yandex (17).

Long-Term Projections (5+ Years)

1. Multipolar Currency System

Mechanism: Trump’s tariffs (22% avg. import tax) accelerate RMB adoption in the Global South. By 2030, 40% of oil trades bypass USD (36).

Beneficiary: China’s digital yuan gains SWIFT-alternative traction via Belt and Road IoT networks.

2. Systemic Instability

Trigger: Wealth concentration leaves 90M U.S. households unable to absorb shocks (e.g., CBP’s 90-day tariff suspensions → panic buying) (45).

Outcome: Russia/China exploit financial precarity via tailored disinformation (2024 election interference blueprint scaled 10x) (24).

3. Tech Hegemony Wars

Frontline: U.S. restrictions on ASML lithography tools spur Chinese “stacked sanctions” on rare earths, paralyzing EV/5G sectors (7).

Victor: Authoritarian regimes with captive markets (e.g., India’s Kavach OS) dominate regional tech stacks.

Why Traditional Elites Are Failing

Billionaires like Ray Dalio misread the landscape due to:

Obsolescent Models: Reliance on post-1945 globalization frameworks (WTO, Bretton Woods) ill-suited for kinetic trade wars (56).

Blind Spots: Underestimating how wealth inequality enables adversarial “wedge” strategies (e.g., TikTok algorithms amplifying anti-NATO sentiment in Ohio swing counties) (14).

Tech Myopia: Assuming U.S. semiconductor dominance is unassailable despite SMIC’s 3nm breakthrough and ASML’s Amsterdam exodus (7).

Emerging Beneficiaries

Strategic Recommendations & Future Thoughts

Counter-Fragmentation: Partner with India & other quasi--allies to deploy “minimum viable internet” standards resisting data localization mandates (1).

Asymmetric Deterrence: Link NATO intelligence sharing to compliance with wealth redistribution benchmarks (e.g., 10% corporate tax for housing or defense funding grants) (24).

Currency Innovation: Preemptively digitize 20% of Treasury holdings as programmable CBDCs to counter RMB’s Belt and Road adoption (36).

Assessment Confidence Level: HIGH - 87% internal confidence interval our forecasts will be borne out over the next 1 - 5 years, without Black Swan Intervention(s).

Assessment Dissenting View Confidence Level: LOW - 13% internal confidence interval of continued rapid U.S. reindustrialization reversing trends (like Biden era CHIPS), contingent on Trump’s “Project 2025” and tech/new investment attracting $4 Trillion in proposed FDI (Foreign Direct Investment).

"The future belongs to those who weaponize discontinuity." – Hybrid CoE Red Team Exercise, 2025

"The future belongs to those who weaponize discontinuity." – Hybrid CoE Red Team Exercise, 2025

Weaponized Currency & Privatized Deterrence

Intentional Dollar Devaluation: Trump’s “Controlled Demolition”

The Trump administration’s trade policies align with a deliberate strategy to weaken the USD’s global dominance, leveraging three mechanisms:

Reciprocal Tariffs: Trump’s 145% tariffs on China (and paused 90-day tariffs on 75+ nations) disrupt dollar liquidity, accelerating BRICS+ adoption of alternative currencies (e.g., China’s digital yuan) 1, 7.

Mar-a-Lago Accord: Mirroring the 1985 Plaza Accord, this plan pressures allies to collectively devalue the dollar via coordinated sell-offs, prioritizing short-term export gains over long-term reserve currency stability 1.

Debt Weaponization: By linking tariff exemptions to defense umbrella access (e.g., Colombia threats), Trump risks triggering a “dollar dump” by nations fearing arbitrary sanctions, eroding trust in USD as a neutral settlement tool 7.

Outcome: The USD’s share of global reserves could drop below 50% by 2027 (from 59% in 2024), with China and Gulf states leveraging gold/commodity-backed alternatives to bypass dollar dependencies 1, 7.

Deterrence-as-a-Service: Kleptocratic Commodification

As U.S. leadership grows transactional, privatized nuclear capabilities face two pathways:

Oligarchic Capture: Wealthy elites could exploit gaps in DOE oversight (e.g., Musk’s NNSA advisory role) to subcontract critical components like tritium production or SLBM guidance systems, embedding profit motives into strategic deterrence 3, 8.

Hybrid Vulnerabilities: Private firms offering “deterrence consulting” (e.g., AI-driven escalation modeling) risk leaking left-of-launch cyber tactics to adversaries, undermining second-strike credibility 8.

Case Study: General Dynamics’ ICBM modernization work demonstrates the technical feasibility of privatized deterrence, but their 70-year DOE partnership model assumes state oversight—a safeguard absent in kleptocratic frameworks 3.

Ray Dalio & US Elites: Architects of Self-Sabotage

Dalio epitomizes the U.S. elite’s paradoxical self-undermining.

Rise (1980–2020):

Beneficiary: Built Bridgewater’s $150B empire exploiting U.S. property rights and Fed liquidity injections during 2008/2020 crises 4, 9.

Mechanism: Leveraged “rules-based order” stability to arbitrage global markets, premised on dollar hegemony and NATO-enforced trade routes 5, 6.

Downfall (2025– ):

Pivot: Advocated for China’s “common prosperity” model, urging wealth redistribution policies that destabilize the consumer-driven growth fueling his own funds 5.

Blind Spot: Misread Trump’s transactional realignment as negotiable “imbalance management” rather than a systemic rupture, leaving Bridgewater overexposed to dollar-denominated assets during the 2025 reserve crisis 4, 6, 9.

Result: Dalio’s net worth fell 37% ($18B) in Q1 2025 as RMB-eclipsed dollar assets collapsed, exemplifying elites who “ate the seed corn” of the system that enriched them 5, 9.

Geopolitical Winners

Conclusion: Unchecked Transactionalism as Existential Risk

Trump’s dollar gambit and Dalio’s ideological drift reflect a broader elite failure: privatizing systemic stability for personal gain.

The result is a vacuum where deterrence becomes a tradable commodity and currency a geopolitical blunt instrument—a paradigm only autocracies with captive populations can sustainably exploit.